direct vs indirect cash flow forecasting

Closing balance of fixed assets plus depreciation minus opening balance. Allocable as a cost that has a direct benefit and is directly attributable to the project being performed.

Indirect Cash Flows Example Youtube

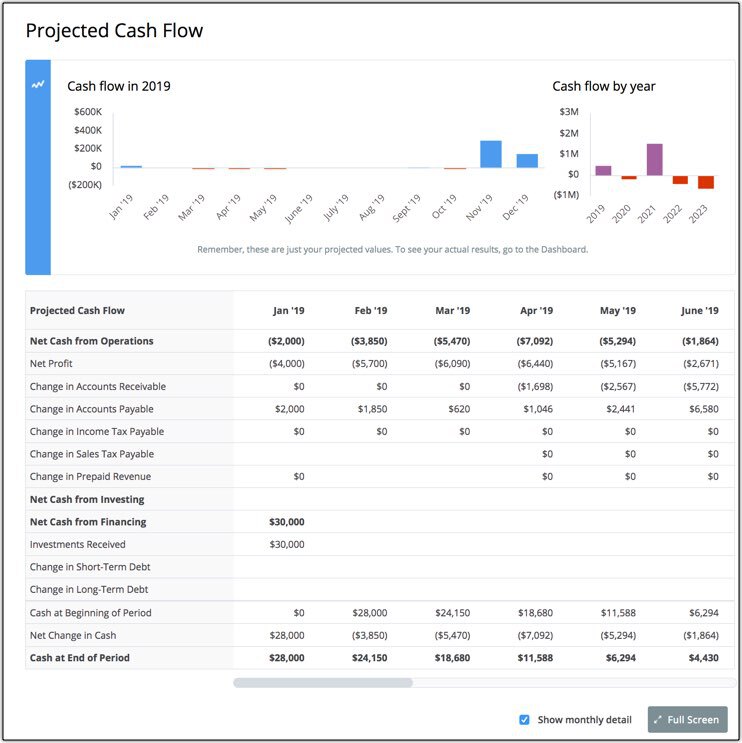

You can perform a cash flow forecasting using either the direct or indirect method.

. So if the direct method is so accurate why would you use the indirect method. Indirect cash flow forecasting. The cash flow methods affect just the cash flow from the operating activities while the cash flow from the investment and financing sections remain the same under both methods.

How To Prepare A Statement Of Cash Flows. Generally there are two categories of cash flow forecasting techniques. Direct Cost Vs Indirect Cost.

There are no presentation. Cash flow forecasting is a core part of financial planning and assists with the day-to-day management of a business. The indirect method is widely used by many businesses.

Generally companies start with direct cash flow forecasting to understand their daily cash movements. If you run a toy store the purchase of the toys is a direct cost. This helps them to identify borrowing or investment opportunities.

Generally speaking the indirect method is easier to use. Direct Cash Flow Forecasting Zeroes In On The Ground Game. When considering direct vs indirect cash flow preparation ways all you would report with the first one is cash receipts and cash payments from operating activities.

Regardless of whether the direct or indirect method is used confidence in cash flow forecasts can help business leaders make more informed decisions regarding how to spend and conserve a companys cash. Eventually youll need to switch to indirect cash flow forecasting as your company expands. Generally there are two categories of cash flow forecasting techniques.

The case for the direct method cash flow is that the Financial Accounting Standards Board recommends it. Indirect cash flow forecasting. Cash flow forecasting is a way to learn where a company stands in terms of its financial position by keeping track of the finances of a company and predicts where a company is heading.

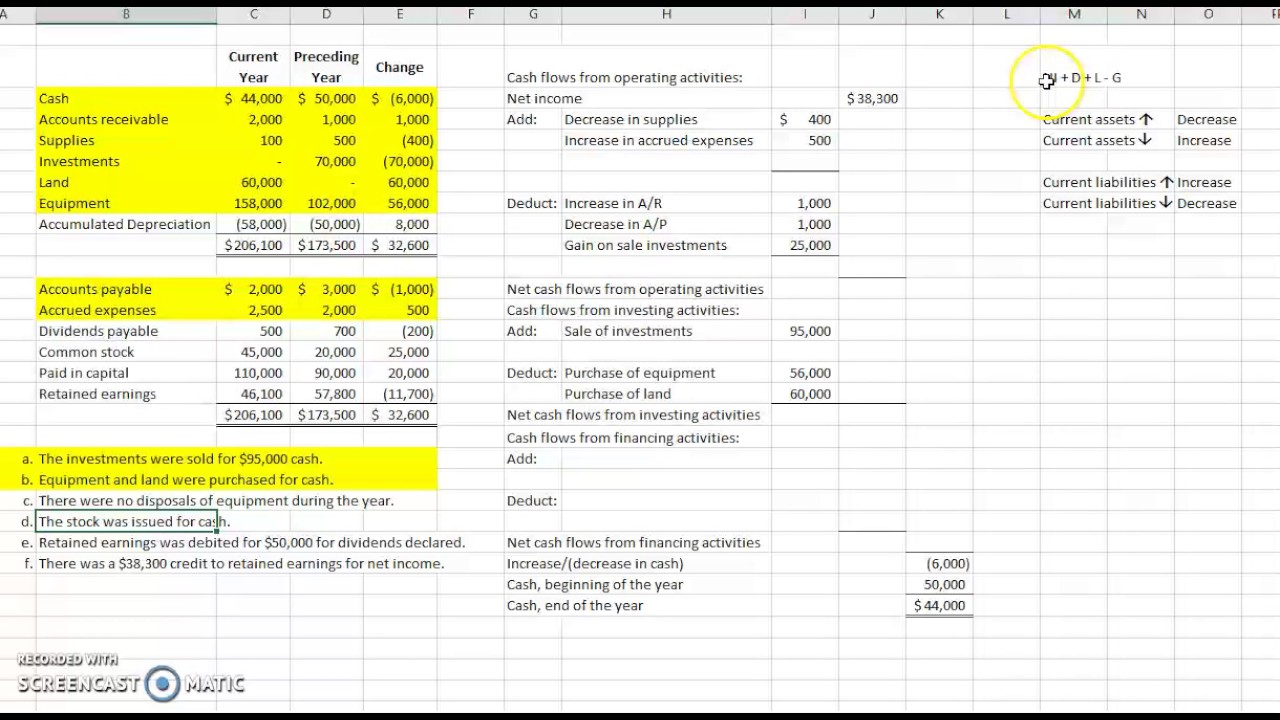

In the case of direct cash flow methods changes in cash payments are reported in cash flows from the operating activities section. In fact its the only feasible way of producing a cashflow forecast manually its too difficult to model any volume transactions by hand so in the past most finance people have relied on the indirect method. Comparing the Direct and Indirect Cash Flow Methods.

A business might use direct cash flow forecasting at the beginning of a month for example to make sure that it will have enough working capital to pay end-of-month bills. However youll still need to reconcile your cash flow to the balance sheet. Indirect cash flow method on the other hand the calculation starts from the net income and then we go along adjusting the rest.

As a rule companies start out with direct cash flow forecasting to get an idea of daily movements. Indirect cash flow forecasting. The difference between these methods lies in the presentation of information within the cash flows from operating activities section of the statement.

Direct cash flow forecasting. The direct cash flow forecast gives you two invaluable things according to Gill. Ability to draw prompt conclusions.

Changes in asset and liability accounts that are capable of affecting your cash balances in a defined reporting period are added or subtracted from your net income at the beginning of. The main difference between the two methods relates to the cash flows from the operating activities. As you are simply making a few adjustments to one figure you can arrive at your final figure much quicker than the direct method.

Eventually they switch to indirect cash flow forecasting as the company expands or plans for acquisitions. Such information is not available under the indirect method. Whereas the direct method will only focus on the cash transactions and produces the flow from the operations of your business.

In the case of an indirect cash flow method changes in assets and liabilities accounts are adjusted in the net income to replicate cash flows from. Under the direct method you present the cash flow from operating activities as actual cash outflows and inflows on a cash basis without beginning from net income on an accrued basis. Thats primarily because it provides a clearer picture of cash inflows and outflows.

The indirect method which is best for longer terms uses. Direct cash flow forecasting. This is because it uses adjustments where the direct method does not.

Moreover each business is different and may prefer a certain way. Purchase of fixed assets such as property plant and equipment PPE a negative cash flow activity. There are at least a few advantages to it including.

Its also important to note that the accuracy of the indirect method is slightly less than the direct method. Reason being that the direct method provides information which may be useful in estimating future cash flows of an entity which helps the users in their decision making for eg for estimating the market value of an entity for estimating the future liquidity position etc. The main difference between the direct method and the indirect method of preparing cash flow statements involves the cash flows from operating expenses.

Which Cash Flow Method Is Better. This is an essential part of measuring day-to-day cash flows and knowing whether to buyborrow investment opportunities. Cash flow forecasting is a way to learn where a company stands in terms of its financial position by keeping track of the finances and predicting where a company is heading.

The direct method ideal for shorter periods identifies all likely future inflows and outflows. Direct forecasting deals with known costs and this method is generally appropriate for short-term forecasting. Direct cash flow forecasting.

It is a simple way of calculating your cash flow and can be done quickly from data readily available in your accounting software. Ability to show the main sources of inflow and directions of cash outflow. The direct method and the indirect method are alternative ways to present information in an organizations statement of cash flows.

Reporting The primary distinction between the direct and indirect cash flow statements is that operating activities generally report cash payments and cash receipts occurring. The indirect method is often easier to use than the direct Direct vs. The indirect method of creating a statement of cash flow entails using changes in your balance sheet accounts to calculate cash flow from operating activities.

Key Differences Between Direct Vs Indirect Cash Flow Methods.

Direct Vs Indirect Cash Flow Statement Excel Model 365 Financial Analyst

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Example Direct Method Of Cash Flow Statement Financiopedia

Direct And Indirect Cash Flow Statement Comparison Cash Flow Statement Cash Flow Positive Cash Flow

Differences Between Direct And Indirect Cash Forecasting Cashanalytics

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Direct Indirect Method Of Cash Flow Forecasting Float

Free Cash Flow Statement Templates Smartsheet Cash Flow Statement Spreadsheet Template Cash Flow

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Direct And Indirect Cash Flow Statement Comparison Cash Flow Statement Cash Flow Positive Cash Flow

Statement Of Cash Flows Indirect Method Format Example Preparation

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Free Cash Flow Forecast Templates Smartsheet Cash Flow Budget Forecasting Personal Finance Budget

Statement Of Cash Flows Direct Method Youtube

Statement Of Cash Flows Significant Non Cash Activities Bookkeeping Business Cash Flow Statement Accounting Classes

Prepare The Statement Of Cash Flows Using The Indirect Method Principles Of Accounting Volume 1 Financial Accounting